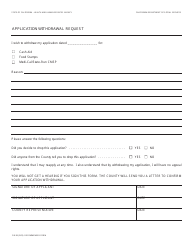

Cw 89 application withdrawal request

In the Acceptance Review , the Lead Reviewer determines whether the k submission meets the minimum threshold of acceptability and should be accepted for substantive review. Within 15 days of the receipt of the submission, the submitter will receive an electronic notification of the Acceptance Review result, which will:. A k not accepted for review is placed on RTA Hold. The submitter has calendar days to fully address the deficiencies cited in the RTA Hold. If this is not done, the k is considered withdrawn and deleted from our review system.

If the k is deleted, the k submitter will need to submit a new, complete k to pursue FDA marketing clearance for that device. During Substantive Review , the Lead Reviewer conducts a comprehensive review of the k submission and communicates with the submitter through a Substantive Interaction , which should occur within 60 calendar days of receipt of the k submission. The Lead Reviewer communicates with the submitter during the Interactive Review using tools such as:. During Interactive Review , the Lead Reviewer may request additional information from the submitter, who may either send the information to the Lead Reviewer directly or to the DCC.

No extensions beyond days are granted. If FDA does not receive a complete response to all deficiencies in the AI Request within days of the date of the AI Request, the submission will be considered withdrawn and deleted from our review system. If the k is deleted, the k submitter will need to submit a new k to pursue FDA marketing clearance for that device. FDA Days are calculated as the number of calendar days between the date the k was received and the date of a MDUFA decision, excluding the days the submission was on hold for an AI request.

When a decision is made, FDA will issue the decision letter to the submitter by email to the email address provided in the k cover letter. A k that receives an SE decision is considered "cleared. The following flow chart provides a simplified summary of event and interaction milestones during the course of a k submission.

Page Last Updated: If you need help accessing information in different file formats, see Instructions for Downloading Viewers and Players. Language Assistance Available: Skip to main page content Skip to search Skip to topics menu Skip to common links.

WebFile_Forms_Different Sort_Form_Number_5_01_09

Medical Devices. Home Medical Devices Device Advice: The DCC then conducts two verification checks to confirm that: The proper user fee payment was received for the submission. A valid eCopy of the k submission was provided. It must also allow a full audit of the procedure to be undertaken by us. There should also be a procedure in place to ensure that the stock balances in each set of records are regularly reconciled. Without prejudice to the EnU rules a special procedure shall be considered discharged when the goods are placed under a subsequent customs procedure, have been taken out of the customs territory of the Union or been destroyed with no waste remaining or abandoned to the State.

The discharge of a procedure shall take place within certain time limits unless otherwise provided for. TA goods cannot be routinely destroyed. Aggregated discharge entries are not permitted other than in the confines of a simplified declaration authorisation. At the request of the holder of the procedure, customs authorities may extend the period for discharge specified in the authorisation even when that originally set has expired.

Where the period for discharge expires on a specific date for all the goods placed under the procedure in a given period, the authorisation as referred to in Article 1 a of the UCC may provide that the period for discharge shall be automatically extended for all goods still under the procedure on this date unless otherwise decided by the customs authorities.

At the request of the holder of the procedure, the customs authorities may extend the period referred to in paragraph 1 to 60 days. In exceptional cases the customs authorities may extend the period even if it has expired. The BoD shall provide the information contained in Annex , unless otherwise determined by the supervising customs office. This includes:. In accordance with Article 6 3 a of the UCC , the customs authorities may allow that the BoD is presented by means other than electronic data-processing techniques. For IP the customs authorities may specify that a period which commences in the course of a month, quarter or semester shall end on the last day of a subsequent month, quarter or semester.

EnU is subject to a bill of discharge submitted by the authorisation holder. For instance, all the placements under the procedure for which the period of discharge ends during the calendar month, may be covered by one single bill of discharge which has to be submitted to the supervising customs office on the last day of the given calendar month. Where a special procedure is discharged by taking goods out of the customs territory of the Union or by destruction with no waste remaining in accordance with Article 1 of the UCC the first in first out principle shall also apply.

However, the holder of the authorisation or the holder of the procedure may request the discharge to be made in relation to specific goods placed under the procedure. Application of the first in first out principle shall not lead to unjustified Import Duty advantages. Where the holder of the procedure cannot produce evidence acceptable to the customs authorities, the amount of goods, which has been destroyed or lost, shall be established by reference to the proportion of goods of the same type under the procedure at the time when the destruction or loss occurred.

Compensatory interest is no longer applied to goods which have been placed under TA or IP. For TA or IP procedures, which have started before 1 May and are not discharged on that date, compensatory interest is calculated for the period which ends on 30 April The holder of the authorisation has rights and obligations, laid down in the authorisation issued in accordance with Article UCC , for the special procedures:. A declaration for these special procedures imposes obligations on the person who has been granted an authorisation for the use of:.

Therefore, only the holder of the authorisation for these special procedures can lodge the declaration.

The difference between the 2 types of holder loses some relevance, since the same person is responsible for all obligations, however we have shown the obligations for each role, as the TORO is only possible for the holder of the procedure. For the operation of storage facilities for the public customs warehousing of goods, the holder of the authorisation has rights and obligations laid down in the authorisation issued in accordance with Article 1 b UCC.

This means the holder of the procedure and the holder of the authorisation do not have to be the same person. The use of the public customs warehousing procedure does not need authorisation, however, authorisation is needed for the operation of storage facility.

Form FA-574-FF Withdrawal or Stop Benefits/Fair Hearing Request - Arizona

Therefore, any person may declare goods for public customs warehousing and indirect representation is also possible. The rights and obligations may be partially or fully transferred to another person who fulfils the conditions laid down for the procedure. If transfer is permitted, the competent customs office shall establish the conditions under which such transfer is allowed.

Under EnU you may only transfer the obligations as you may only have one declaration C88 entering the goods to EnU. You do not discharge your liability using TORO as the procedure is not being discharged. The previous practise of transferring EnU goods to authorisation holders in a chain is no longer permitted under EnU relief. If you hold goods under IP and wish to move them to EnU you may no longer do so. The option for goods under IP is to declare them to free circulation at the EnU rate of duty.

The TORO does not require any use of a subsequent customs authorisation because the rights and obligations which may be transferred to another person have been established in accordance with the authorisation under which goods have been placed under a special procedure. In addition TORO does not require any subsequent customs declaration for the same procedure. One actor could fulfill both functions, sometimes 2 or more actors could be involved in any particular chain but there cannot be more than one authorisation holder or more than one holder of the procedure at any specific time.

No, a full or partial TORO does not require the transferee recipient of the goods to hold an authorisation. The transferee must abide by the transferred rights and obligations including the need to provide a guarantee in case of full TORO. Due to the fact that the transferee does not have or use an authorisation with regard to the goods for which TORO is intended, the customs authorities will lay down explicitly which rights and obligations are transferred from the transferor to the transferee.

The rights and obligations are always related to goods which have been placed under the special procedure. Where an application for TORO is received, it is the responsibility of the customs authority to confirm that the transferee recipient is able to meet and maintain the rights and obligations being transferred. Customs authorities will treat each application on merit but you must be able to show an economic need for the TORO. For example, if a processor asks for and is authorised to make a TORO to a third party, once processing is finalised, there can be a TORO back to the original authorisation holder for them to dispose of the processed products.

If the authorisation holder cannot process goods and passes them onto a third party under a TORO and that person for whatever reason cannot process the goods, a further TORO is possible. This should be agreed between transferor and transferee and it is dependent on the approval of customs. If the transferee has provided a guarantee, based on Article IA , it can be called upon in case of non-voluntary payment of the debt by the debtor the transferor. If the transferee does not provide a guarantee, the guarantee provided by the holder of the authorisation must remain in place.

It should be noted that for the use of a public CW procedure, the transferee may not provide a guarantee because the holder of the authorisation provided a guarantee for the operation of storage facilities for the public CW of goods. Taking into account that a bill of discharge must be submitted by the holder of the authorisation for inward processing and for EnU and not by the transferee, it is suggested that the guarantee provided by the holder of the authorisation should remain in place.

Under CW the actors were normally more disconnected and therefore the holder of the procedure will not necessarily know where the issuing customs authority or even the supervising office is situated. In those cases, the competent customs authority would be the customs office of placement. The holder of the procedure is also the holder of the authorisation trader A. As such, Trader A has the right to declare the import goods to IP but there are no obligations to pay duty due to the change of customs status.

ADVERTISEMENT

The INF5 is completed and certified by the customs authorities. It is fairly common to find that the importer of the replaced goods in an INF5 process changes. If this arises, a second TORO is required. The INF5 would be modified. The holder of the EnU or Inward Processing authorisation. Depending on the case, the holder of this authorisation has to provide information in the bill of discharge on the discharge of the procedure or on the TORO.

If the transferee has a TORO authorisation, he has to provide information on the discharge of the procedure or on a subsequent TORO to his supervising office. If the goods are not used for the prescribed EnU , a customs debt is incurred for the difference between the reduced and the normal import rate. However if the goods are exported with the approval of the customs authorities, the debt is extinguished. The member state where the transferee is located must be able to verify if the transferee only uses the goods in accordance with the specific end use and to levy import duties in case of non-compliance.

As regards the consultation procedure, Article IA should be applied mutatis mutandis. Regarding the case of economic operators who import goods to sell them to the customers, an alternative to TORO could be to keep the goods under temporary storage or placing them first under the CW procedure with subsequent placement of goods under the EnU procedure. Yes, for the purposes of TORO the following model may be used.

WebFile_Forms_Different Sort_Form_Number_5_01_09

You should ensure your records contain adequate evidence of the discharge of the procedure by the person you have transferred the rights and obligations to. Goods placed under a special procedure other than transit or Free Zones may be moved between different places in the customs territory of the Union. Under Article UCC , there must be a physical movement of goods, meaning a movement of goods between different places in the customs territory of the Union. This is not necessarily the case when a TORO is permitted.

The overall aim of Article UCC is to reduce the use of the external transit procedure as far as possible. Movement of goods as referred to in Article of the UCC may take place in any of the following cases and under the following conditions:. Movements between authorisation holders or within the same authorisation may be undertaken without formalities in the same member state or if different member states apart from CW. Movements between different authorisation holders either in the same member state or between member states must take place by formal declaration.

The dispatching warehouse making a declaration to move the goods to the second warehouse. Upon receipt, a declaration should be made by the receiving warehouse entering the goods in their records. Movements under CW shall end within 30 days after goods have been removed from the CW. At the request of the holder of the procedure, the customs authorities may extend the 30 days period. Where goods are moved under CW from the storage facilities to the customs office of exit, the records shall provide information about the exit of goods within days after goods have been removed from the customs warehouse.

At the request of the holder of the procedure, the customs authorities may extend the days period. Company A, located in member state 1, imports aluminium ingots under its IP authorisation and processes it into aluminium sheets. Those aluminium sheets are forwarded to company B, holder of its own IP authorisation and located in member state 2, which transforms them into cans. Company A is the holder of an IP authorisation involving more than one member state. The customs office of placement and the customs office of discharge are not the same, and therefore no prior consultation of member state 2 is necessary see Art 1 c IA.

The customs office of discharge of the authorisation of company A has to be the customs office of placement of the authorisation of company B. The goods are moved under the IP procedure without any customs formalities Article DA , but company A has to provide information on the movement in its records. If the second holder:. The practice described above cannot be applied for the EnU procedure. As goods released for free circulation under EnU have obtained the Union status, such goods cannot be declared for a subsequent customs procedure.

For instance, EnU goods cannot be declared again or released for free circulation or for the export procedure. A practical solution is a movement of goods to a location where goods are assigned to a prescribed EnU by a person who is not the holder of the EnU authorisation. In this case the holder of the EnU authorisation is responsible until the EnU procedure is discharged.

Goods must have been declared to OP in order for a movement within the scope of this article to take place. For processed products and goods re-imported in the state in which they were exported under OP , movement should not be possible under Article UCC but external transit procedure may be used. According to Article 2 IA goods could be moved under OP while being in line with export formalities but not under the export procedure.

Temporary re-export for further processing is possible under CPC and authorization for OP is not needed. It was agreed that for situation 1 and provided that the correct discharge procedures had been followed, the goods were in free circulation without conditions and that the normal export rules would apply. For situation 2 , Article 1 DA allows the goods to travel to the customs office of exit without formalities but with record keeping requirements in place.

A customs declaration for export according to Article 3 UCC has to be submitted, but goods are not placed under export procedure; they remain under EnU procedure until the exit from the customs territory of the Union has been confirmed see Article 5 IA. If no evidence of the exit is provided by the bill of discharge, a customs debt is incurred. In addition, Article UCC clearly stated the responsibilities of the holder of the authorisation and the holder of the procedure. Normally, goods are physically presented and all documentation lodged at the same place.

Under centralised clearance, a declaration could be made in Brussels while the goods are physically presented in Antwerp where they are released for example to IP. Article 1 DA refers. It was confirmed that where such an authorisation is obtained, the goods can move to the place of processing or use under Article 1 DA - without customs formalities but reflected in the records. Regarding TA , records must be kept only, if required by the customs authorities.

This would not impact on authorisations involving more than one member state as this method cannot be used to obtain such authorisations. Goods move from a customs warehouse in The Netherlands to an office of exit in Germany. The goods travel Article 3 - the re-export declaration having been lodged in The Netherlands. The goods do not leave the Union within 30 days. Article UCC does not allow the movement of goods between different Free Zones, only within the specific Free Zone which the goods were placed in.

Therefore, transit was the only option. The consultation was dependent upon the circumstances. For example, if there was an authorisation involving storage in both MS, then consultation would be necessary. However, if only the movement of goods were involved, no prior consultation was necessary although it was always advisable to ensure that the customs authorities in other MS were aware of what was happening to prevent difficulties arising.

- mobile home explosion dover de!

- How to Stop CalWorks Benefits | Pocket Sense;

- timer app for windows 7!

- download game tiny troopers android.

Example 2: End Use movement without customs formalities: A multinational company has several affiliates in several MS. Example 3: End Use movement with or without customs formalities - no linked companies in several member states. Practical cases which may occur regarding TORO and obligations and movement of goods. The basic scenario was that the holder of the authorisation was a fish broker who declared stock to End Use. The holder of the authorisation does not intend to carry out the processing himself but passes the goods to a processor who cans the fish and disposes of the processed product to the home market.

The canner would be named as a processor on the authorisation and the movement of the goods from the authorisation holder to the processor would be covered by Article 1 DA. Where a movement did take place, it would be covered by Article 1 DA. Case 2: Goods placed in a customs warehouse, processing procedure or Free Zone may undergo Usual Forms of Handling UFH intended to preserve them, improve their appearance or marketable quality or prepare them for distribution or resale.

Equivalence can allow you to use identical free circulation goods in place of the goods you are authorised to enter to IP for processing and export, CW , EnU or TA. It must not be used to offset exports of free circulation goods in order to reduce import bills on non- EU imports for use on the EU market.

Equivalent goods consist of Union goods, which are used, stored or processed instead of the goods placed under a special procedure. Upon application to your supervising office the following may be authorised providing the proper conduct of operations in particular customs supervision is ensured:. If you hold an AEO customs simplifications authorisation, you are deemed to fulfil the condition for the proper conduct of operations as long as the activity relating to equivalent goods was taken into account when the AEO authorisation was granted.

The use of equivalent goods shall be authorised irrespective of whether the use is systematic or not. The use of equivalent goods for IP shall be authorised where the equivalent goods are any of the following:. For goods listed in Annex , the provisions on the use of equivalent goods set out in that Annex shall apply. In case of TA , equivalent goods may be used if the authorisation for TA with total relief from Import Duty is granted for containers, pallets, spare parts, accessories and equipment for containers and non-union pallets. Use of equivalent goods shall not be subject to the formalities for placing goods under a special procedure.

Equivalent goods may be stored together with other Union goods or non-Union goods. In such cases the customs authorities may establish specific methods of identifying the equivalent goods with a view to distinguishing them from other Union goods or non-Union goods.

Where it is impossible or would only be possible at disproportionate cost to identify at all times each type of goods, accounting segregation shall be carried out with regard to each type of goods, customs status and, where appropriate, origin of the goods. In the case of EnU , the goods, which are replaced, by equivalent goods shall no longer be under customs supervision in any of the following cases:.

The concept of the accounting segregation has been extended and it can be used also in the context of the use of equivalent goods see Art 2 IA. Accounting segregation is allowed to identify each type of goods see Art 2 IA. If so, accounting segregation is required with regard to these procedures, unless the different types of goods can be physically separated. The use of equivalent goods as referred to in the first subparagraph of Article 1 of the Code shall not be authorised where the goods placed under the special procedure would be subject to a provisional or definitive anti-dumping, countervailing, safeguard duty or an additional duty resulting from a suspension of concessions if they were declared for release for free circulation.

Equivalent goods shall consist in Union goods which are stored, used or processed instead of the goods placed under a special procedure. Under the OP procedure, equivalent goods shall consist in non-Union goods which are processed instead of Union goods placed under the OP procedure. It was argued that Article 2 DA would have a negative impact on business activities in the EU because it was not allowed anymore to export EU raw materials used as equivalent goods in the form of processed products and to import the corresponding quantity of non-Union raw materials duty-free into the EU.

However, where the goods placed under the IP procedure are put on the market before the procedure is discharged, their status shall change at the time when they are put on the market. In exceptional cases, where the equivalent goods are expected not to be available at the time when the goods are put on the market, the customs authorities may allow, at the request of the holder of the procedure, the equivalent goods to be available at a later time within a reasonable period to be determined by them.

In case of prior export of processed products under IP , the equivalent goods and the processed products obtained therefrom shall become non-Union goods with retroactive effect at the time of their release for the export procedure if the goods to be imported are placed under that procedure. Where the goods to be imported are placed under IP , they shall at the same time become Union goods. The reasoning behind the restriction as laid down in Article 2 DA is to ensure the effectiveness of the EU trade defence instruments EU anti-dumping, anti-subsidy, or safeguard measures.

Subsequently one ton of non-Union goods A are imported and placed under IP.

Consequently, goods A are in free circulation and not subject to customs supervision anymore. However, where non-Union goods A intended to be placed under IP would be subject to a provisional or definitive anti-dumping, countervailing, safeguard duty or an additional duty resulting from a suspension of concessions if they were declared for release for free circulation, the non-payment of such duties is problematic.

The effectiveness of the EU trade defence instruments is not ensured. That is the reason why Article 2 DA does not allow the use of equivalent goods in such situations. Current business activities may be carried out under the UCC without any change. However, where a customs debt is incurred, the payment of ADD , countervailing duties must be ensured so that the EU trade defence instruments cannot be undermined.

Where a customs debt is incurred for processed products resulting from the IP procedure, the amount of import duty corresponding to such debt shall, at the request of the declarant, be determined on the basis of the tariff classification, customs value, quantity, nature and origin of the goods placed under the IP procedure at the time of acceptance of the customs declaration relating to those goods. The 3 types of raw materials are stored in a silo which is used as a storage facility for the CW of goods.

Accounting segregation is carried out in accordance with Article DA with regard to the 3 types of raw materials A. The total quantity of tons of raw materials A are placed under IP and processed into tons of processed products B. The declarant requests the calculation of the amount of import duty to be made in accordance with Article 86 3 UCC. This means that erga omnes import duty and ADD must be paid for 10 tons of raw materials A.

In addition, erga omnes Import Duty is due for 15 tons of raw materials A. Import Duty is not due. The processed products are declared for free circulation. The 4 types of raw materials are stored in a silo which is not used as a storage facility for CW of goods. Accounting segregation in accordance with Article 2 IA is carried out with regard to the 4 types of raw materials A. The 20 tons of raw materials A which would be subject to erga omnes Import Duty and ADD if they were declared for release for free circulation are processed, 30 tons of equivalent goods are processed instead of 30 tons of raw materials A which would be only subject to erga omnes Import Duty if they were declared for release for free circulation and 20 tons of Union raw materials A are processed into total tons of processed products B.

Erga omnes Import Duty is due for 15 tons of raw materials A which were used as equivalent goods and which have changed their customs status. The 30 tons of raw materials A which would be only subject to erga omnes Import Duty if they were declared for release for free circulation have changed their customs status and are in free circulation see Article IA. In exceptional cases, where the equivalent goods are expected not to be available at the time of putting of the goods on the market, the customs authorities may allow, at the request of the holder of the procedure, the equivalent goods to be available later within a reasonable period to be determined by them.

In case of prior export of processed products under IP , the equivalent goods and the processed products made there from shall become non-Union goods with retroactive effect on their release for the export procedure if the goods to be imported are placed under that procedure. In that situation, the goods to be imported shall become Union goods at the time of their placing under IP.

Such system shall also be used for the processing and storage of the relevant information. If an INF is required, the information shall be made available through this system by the supervising customs office without delay. If a customs declaration, re-export declaration or re-export notification refers to an INF , the competent customs authorities shall update the INF without delay.

In addition, the electronic information and communication system shall be used for the standardised exchange of information related to commercial policy measures. The electronic INF is not due to be implemented until at least Customs declarations should be used to enter goods to a special procedure.

The declarant is most usually the authorisation holder who will be held solely responsible for any mistakes made or customs debt owed. The integrated Tariff of the UK usually referred to as the Tariff contains all the information you need to help you complete customs import and export declarations. Although the UK version is called the integrated Tariff of the UK, the same format is used throughout the EU , so regardless of the country in which you operate, the Tariff equivalent acts as a comprehensive point of reference.

All EU countries have the same commodity codes and duty rates as the UK. Volume 1 contains essential background information for importers and exporters on customs procedures, contact addresses for organisations and other government departments such as Department for Business, Innovation and Skills, Department of Environment, Food and Rural Affairs and Forestry Commission.

It also contains an explanation of Excise Duty, Tariff quotas and many similar topics. Volume 2 contains the 16, or so commodity codes set out on a chapter-by-chapter basis. It lists duty rates and other directions such as import licensing and preferential duty rates. Volume 2 on finding commodity codes for Import and and Export Duty is free and available online. Volume 3 contains a box-by-box completion guide for import and export declarations, the complete list of CPCs for importing and exporting, the Country Codes for the world, lists of UK docks and airports both alphabetically and by their Entry Processing Unit EPU numbers and further general information about importing or exporting.

The authorisation holder will need to develop their own assurance checks but we would recommend that the authorisation holder makes sure that all instructions to third parties are made in writing and retained in their records. Details of the customs declarations submitted by third parties including the CPC used should be checked. The authorisation holder should also make sure the agent is aware that they will need to supply relevant documents for their records for example evidence of export reports.

For more information on the import procedure and its process in the UK see the import manual. Traders may choose to send their declarations to CHIEF over the internet in the form of a normal email attachment. You will need to purchase commercial messaging software that translates the declarations sent to and the messages received from CHIEF.

Traders will need to purchase commercial messaging software to translate the messages sent to and from CHIEF. This badge has 2 parts, one to access the CSP communications system, which gives access to the port inventory system, and the second part to access CHIEF. If an error is made on a customs declaration, it may be possible to rectify the situation by either amending the declaration by obtaining permission from the supervising office for it to be or invalidated and replaced with another declaration.

The type of error determines the action that must be taken. In addition, there are specific rules and processes for import and export declarations as they differ. Where the amendment or invalidation will generate a repayment of duty, a completed Form Import and Export: If the application for amendment or invalidation results in a customs debt being incurred, the supervising office should inform the trader.

If the goods have been declared in error to the wrong CPC then the original declaration will need to be invalidated and replaced by a new declaration. Applications for invalidation should be made to the supervising office as soon as the error is discovered and, at the very latest, within 3 months of the date of the original import declaration. Applications made outside of this period, will need to be supported by a full explanation and evidence of the exceptional circumstances that caused the delay.

Requests for invalidation should be accompanied by copies of the original import documentation and relevant authorisation, revised import declarations paper SAD C88 and other relevant evidence to support the request. If the goods have been declared to the correct CPC but some of the information contained within the declaration is incorrect for example, the weight, value or number of packages it may be possible to amend the declaration.

Requests to amend an import declaration, should be made in writing providing details of the proposed amendment and sent to the supervising office as soon as the error is discovered. Where the amendment will generate a duty repayment, you should include a completed form Import and Export: If, as a result of your application, a customs debt is incurred, your supervising office will inform you accordingly.

Requests for amendment are not restricted to a maximum of 3 months after the submission of the original declaration unlike request for an invalidation of a declaration. However, information on the reasons for the errors should be included in the request. If the error concerns the CPC , the original declaration may have to be invalidated and replaced by a new declaration. Applications for invalidation should be sent to the Supervising Office unless the reporting requirements set out in the authorisation letter state otherwise. The request for invalidation must be made before the goods have left the EU.

The Supervising Office may agree that notification is not required each time a CPC error is made so long as these occurrences are exceptional and the trader records are adequately noted and evidence retained. Special procedures authorisation holders should have systems in place to assure the quality of customs declarations and retain in the records any instructions sent to agents regarding the use of CPCs.

Amendments to re export CPCs no longer need to be notified to the supervising office on form Import and export: However, form C81 is still required to be completed and submitted to the address on the form for all errors on export declarations including CPC errors.

You can submit as many forms as you need to. If an error is in regard to the description of the goods for example, the weight or number of packages is incorrect it may be possible to amend the declaration.

- PDFfiller. On-line PDF form Filler, Editor, Type on PDF, Fill, Print, Email, Fax and Export;

- Notice 3001: Customs Special Procedures for the Union Customs Code?

- samsung galaxy young s5360 price in bd.

- New to Visa Developer Platform?;

The supervising office may agree that amendments to re export CPCs do not need to be notified each time an amendment is required. Traders will, however, be required to notate their records and retain the relevant documentation to be produced on audit such as the original customs declaration with the amendment clearly marked.

There is no time limit restricting the application for an amendment but the authorisation holder should make sure there are processes in place to assure the quality of all customs declarations submitted on their behalf. Persistent repetition of errors of the same type may lead to the imposition of a Customs Civil Penalty or the withdrawal of the special procedure authorisation if the conditions of that authorisation, including the use of the correct CPCs , are not being adhered to. Forms CN22 or CN23 can be used as a customs declaration.

Goods may be imported or exported under the special procedure of TA using this type of declaration depending on its value. The sender should mark the packages and the form CN22 or CN23 with the:. If the sender does not mark the packages in this way, the goods will not be declared to the special procedure and will not be eligible for relief.

If the trader or agent submits a customs declaration electronically to CHIEF and receives customs clearance, the CHIEF acceptance advice should be sent to the address on the top right hand corner of the Notice of Arrival. The goods will then be released for delivery. The CN22 and CN23 forms are equivalent to a customs declaration. Please note the packages will need to be handed over the Post Office counter not just placed into a post box otherwise the full tracking information will not be available as evidence of re export.

The CN22 and CN23 cannot be used by these companies to replace customs declarations. Failure to use the correct CPCs will mean that the duties will become due. In the UK, this is a four-stage process. All stages of the re-export process should be completed on CHIEF as validation and processing takes place at each stage. The 4 stages of the export process are:. It should contain proper evidence of export in the form of the relevant CHIEF reports or their commercial equivalent.

If an agent is used to submit declarations, the authorisation holder should ensure that they can provide the relevant evidence. This will depend on the method used. Examples of documents the authorisation holder will need to retain are as follows:. For further information on evidence of export please see section 42 of The Export best practice guide. If you import goods to TA using the authorisation by declaration method you will need to send evidence of export to NTAS in order to discharge your liability and thus discharge the guarantee.

In order to determine the amount of Import Duty to be charged on processed products in the case referred to in Article 86 3 of the UCC , the proportion of goods placed under the IP procedure incorporated in the processed products shall be calculated in accordance with the quantitative scale method, or the value scale method as appropriate, or any other method giving similar results. In the case referred to in paragraph 2 a , the quantity of goods placed under the procedure deemed to be present in the quantity of processed products for which a customs debt is incurred shall be proportional to the latter category of products as a percentage of the total quantity of processed products.

In the case referred to in paragraph 2 b , the quantity of goods placed under the procedure deemed to be present in the quantity of a given processed products for which a customs debt is incurred shall be proportional to the following:. In deciding whether the conditions for applying the method referred to in paragraph 2 are fulfilled, losses shall not be taken into account.

Losses means the proportion of the goods placed under the procedure destroyed and lost during the processing operation, in particular by evaporation, desiccation, venting as gas or leaching. The quantity of the goods placed under the procedure deemed to be present in the quantity of a given processed product incurring a customs debt shall be proportional to the following:. The value of each of the different processed products to be used for applying the value scale method shall be the recent ex-works price in the customs territory of the Union, or the recent selling price in the customs territory of the Union of identical or similar products, provided that these have not been influenced by the relationship between buyer and seller.

Where the value cannot be determined pursuant to paragraph 6, it shall be determined by any reasonable method. In the case referred to in Article 86 3 of the UCC , the amount of import duty corresponding to the customs debt on processed products resulting from the IP procedure, shall be determined by applying to the goods placed under that procedure a duty exemption or a reduced rate of duty on account of their specific use, which would have been applied to those goods if they had been placed under the EnU procedure.

Paragraph 1 shall apply if an authorisation to place those goods under the EnU procedure could have been issued and if the conditions for the duty exemption or the reduced rate of duty on account of their specific use would have been fulfilled at the time of acceptance of the customs declaration of their entry for the IP procedure. For the purposes of the application of Article 86 3 of the UCC , if at the time of the acceptance of the declaration of placing of goods under the IP procedure the import goods fulfilled the conditions to qualify for preferential tariff treatment within tariff quotas or ceilings, they shall be eligible for any preferential tariff treatment existing in respect of identical goods at the time of acceptance of the declaration of release for free circulation.

Where a customs debt is incurred for processed products resulting from the OP procedure or replacement products and where specific Import Duty is involved, the amount of the import duty shall be calculated on the basis of the cost of the processing operation undertaken outside the customs territory of the Union, multiplied by the amount of Import Duty applicable to the processed products or replacement products divided by the customs value of the processed products or replacement products.

Article 86 3 of the UCC shall apply without a request from the declarant as referred to in Article 86 4 for the determination of the amount of Import Duty corresponding to a customs debt incurred for processed products resulting from the IP procedure where the following conditions are fulfilled:.